Unveiling the Land: A Comprehensive Guide to Putnam County Tax Maps

Related Articles: Unveiling the Land: A Comprehensive Guide to Putnam County Tax Maps

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unveiling the Land: A Comprehensive Guide to Putnam County Tax Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unveiling the Land: A Comprehensive Guide to Putnam County Tax Maps

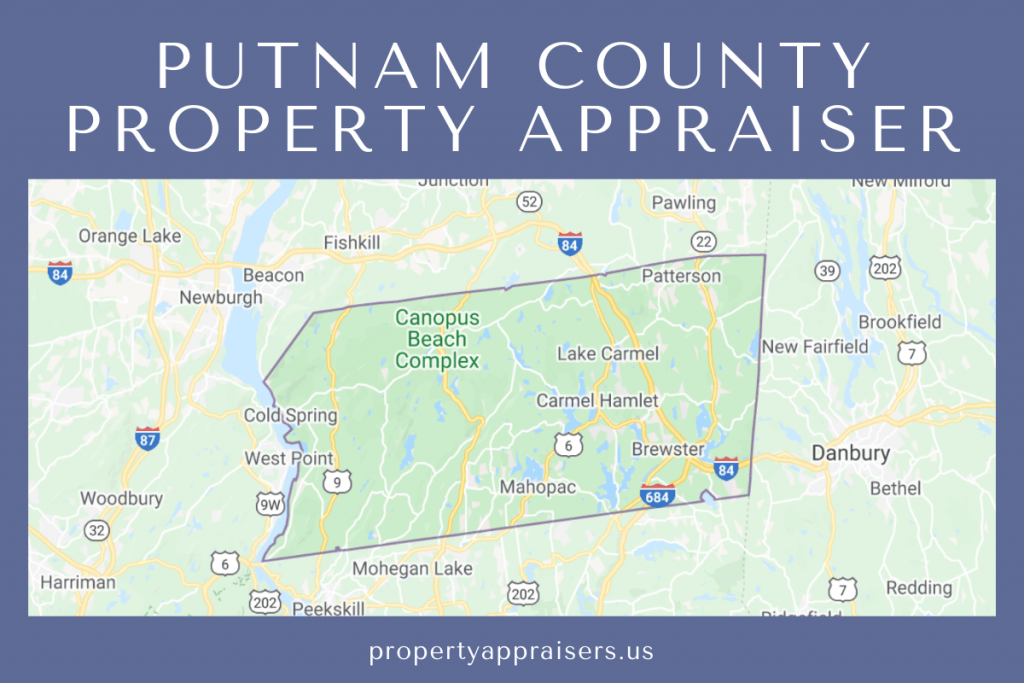

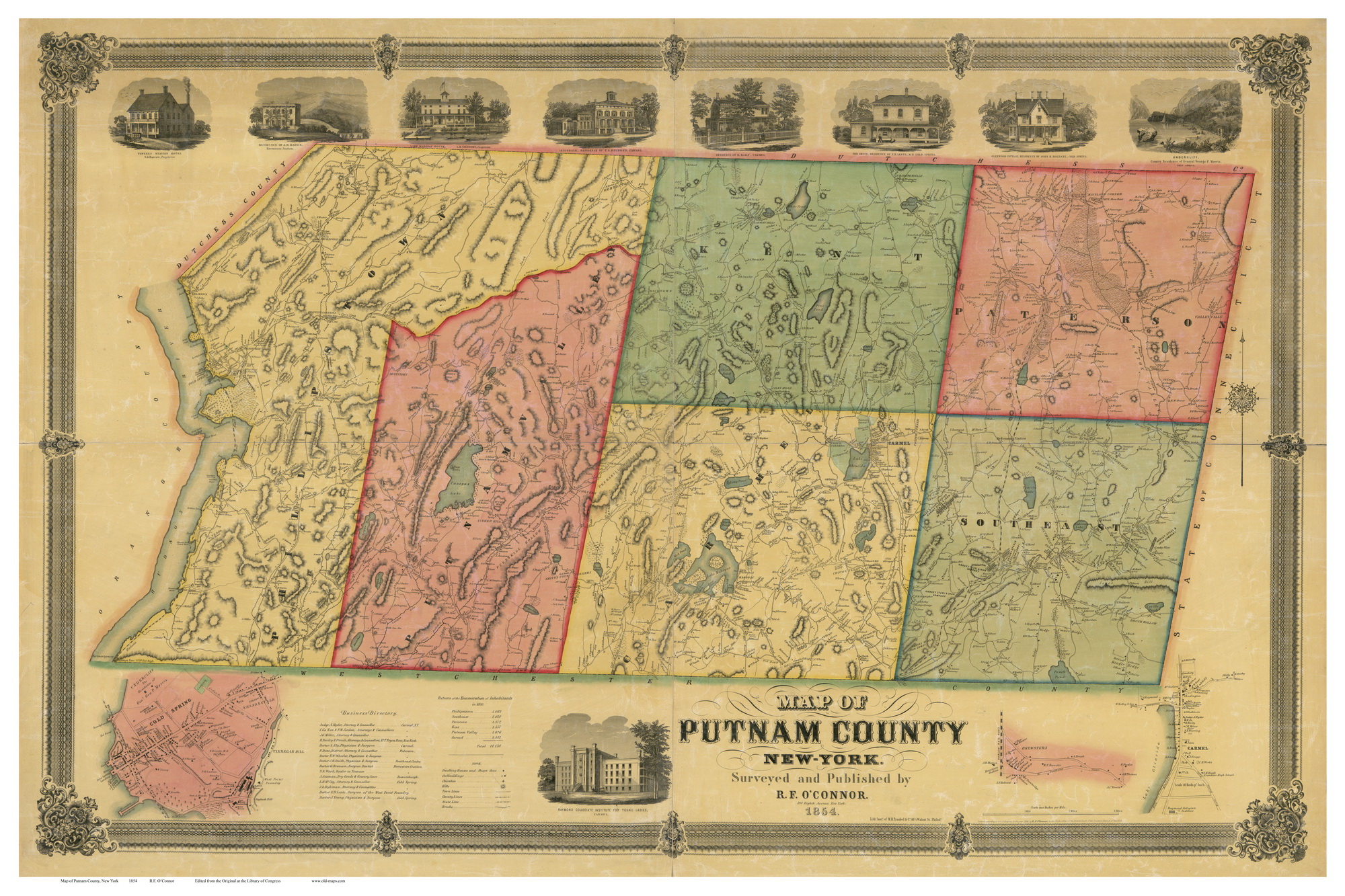

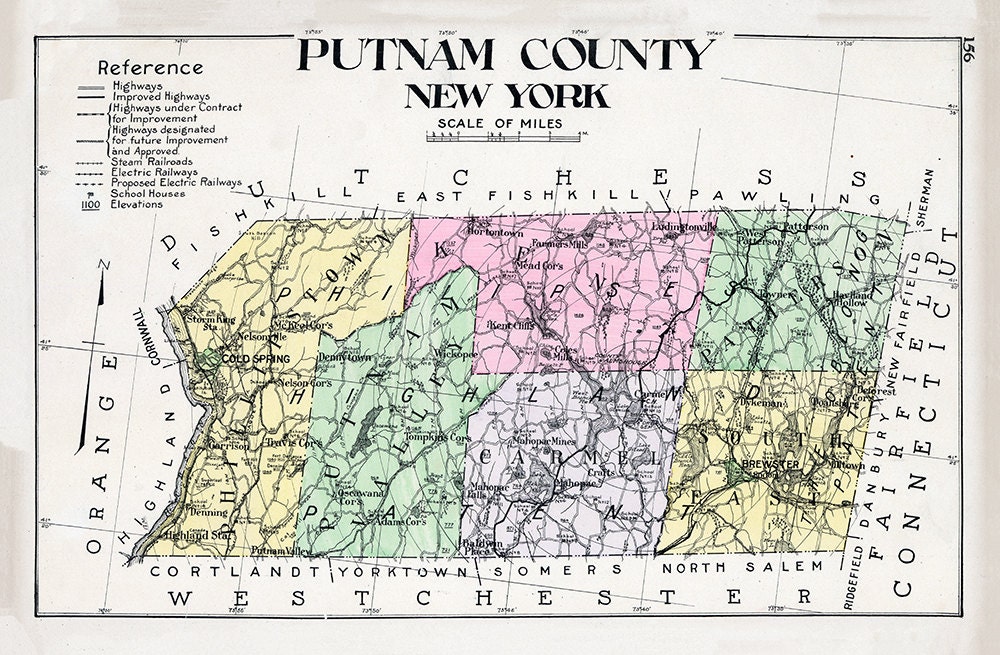

Putnam County, with its picturesque landscapes and rich history, offers a captivating blend of rural charm and urban convenience. Understanding the intricate web of property ownership within this vibrant county is crucial for residents, investors, and those seeking to navigate its diverse real estate market. The Putnam County Tax Map serves as a powerful tool, offering a visual and data-rich representation of the county’s land parcels and their associated information.

Delving into the Depths of Putnam County’s Tax Map

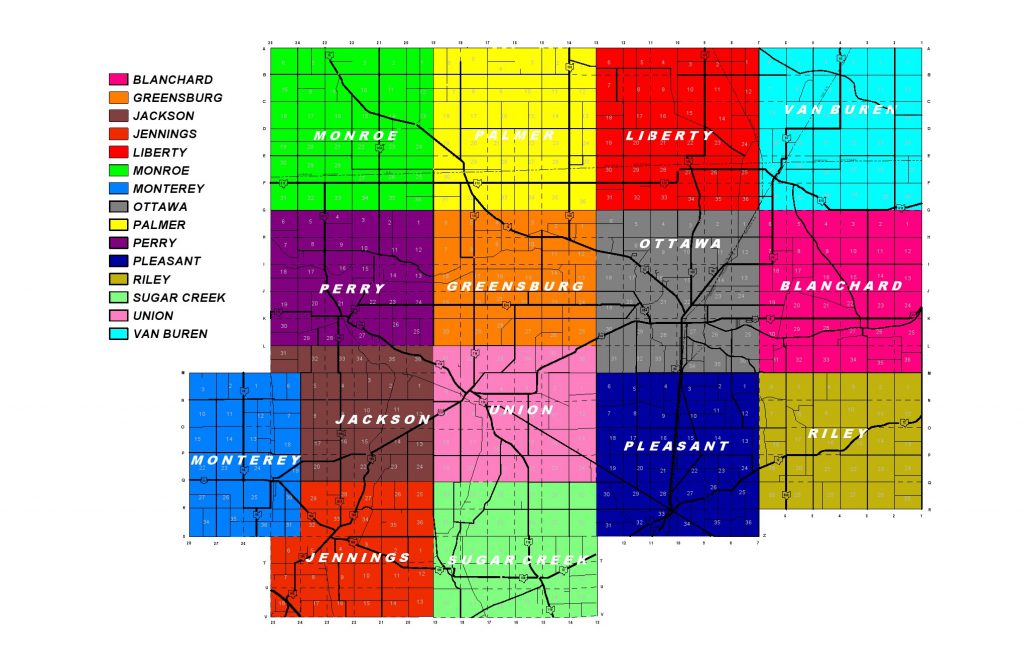

The Putnam County Tax Map is a meticulously crafted digital and physical representation of the county’s land, divided into individual parcels. These maps provide a wealth of information, including:

- Parcel Identification Number (PIN): A unique identifier assigned to each property, serving as its digital fingerprint.

- Property Address: The official address of the property, facilitating accurate location identification.

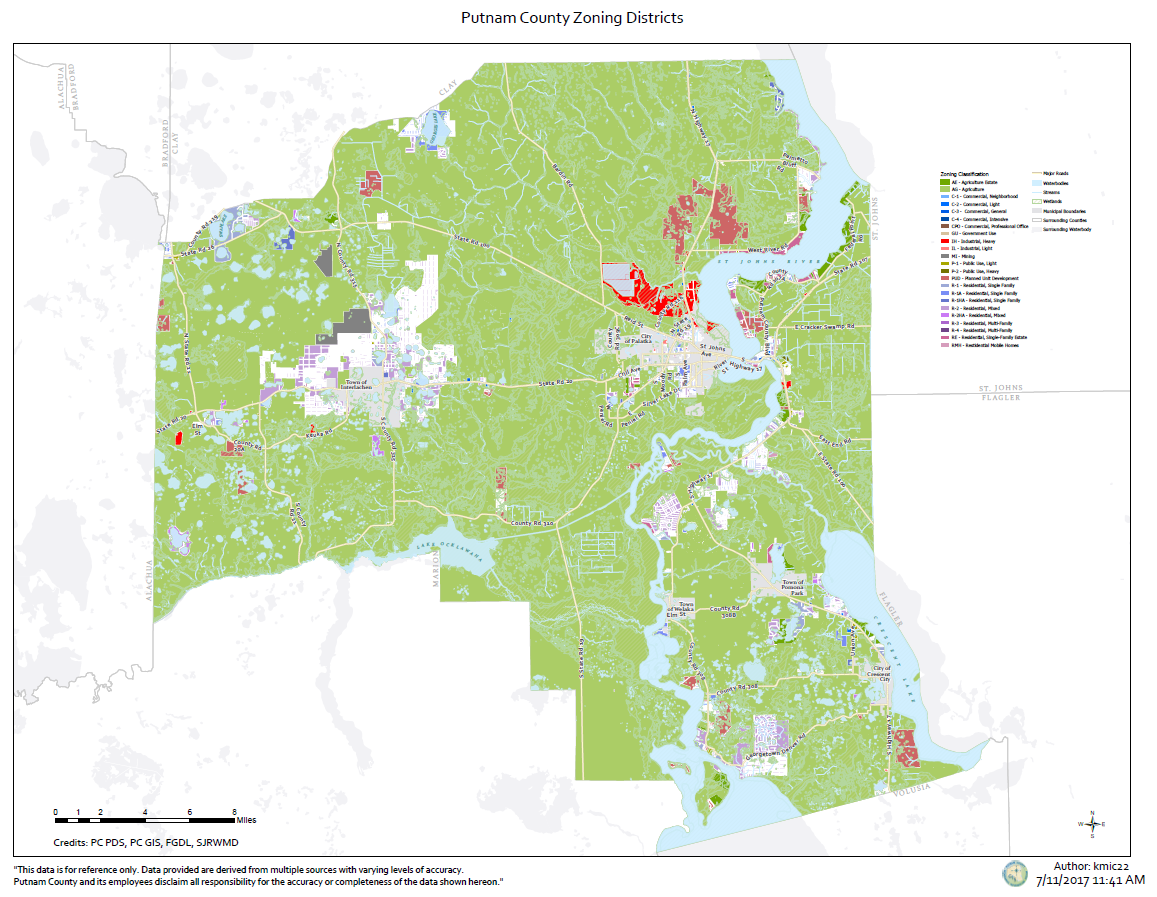

- Land Use: Categorization of the land, indicating its current use, such as residential, commercial, or agricultural.

- Property Owner Information: Details about the current legal owner of the property, including their name and contact information.

- Property Value: Assessed value of the property, used for tax calculations.

- Zoning Information: Regulations governing the permissible use and development of the property.

- Tax Information: Details about property taxes, including the tax rate and any outstanding payments.

Navigating the Digital Landscape: Online Access and Features

The Putnam County Tax Map is readily accessible through various online platforms, offering a user-friendly interface for exploration. These platforms often incorporate advanced features like:

- Interactive Maps: Allow users to zoom, pan, and navigate the map freely, exploring specific areas of interest.

- Search Functions: Enable users to quickly locate properties based on address, PIN, or owner name.

- Property Details: Provide detailed information about each property, including all the data mentioned above.

- Layers: Allow users to overlay different data layers, such as zoning districts, flood zones, or school boundaries, for comprehensive analysis.

- Downloadable Data: Offer the option to download property data in various formats, facilitating further analysis and use in other applications.

Unveiling the Benefits: Why Putnam County Tax Maps Matter

The Putnam County Tax Map serves as a vital resource for various stakeholders, offering a range of benefits:

- Property Owners: Gain a comprehensive understanding of their property’s details, including its assessed value, zoning restrictions, and tax obligations.

- Real Estate Professionals: Utilize the map for property research, market analysis, and client consultations, aiding in accurate property valuations and informed investment decisions.

- Investors: Identify potential investment opportunities based on property values, zoning regulations, and surrounding development.

- Government Agencies: Utilize the map for planning and development purposes, assessing property values for tax revenue, and managing infrastructure projects.

- General Public: Access information about property ownership, land use, and zoning regulations for community engagement, neighborhood awareness, and informed decision-making.

Navigating the Map: A Step-by-Step Guide

Accessing and utilizing the Putnam County Tax Map is a straightforward process:

- Visit the Putnam County Website: Navigate to the official website of Putnam County.

- Locate the Tax Assessor’s Office: The tax map is typically hosted on the website of the county’s tax assessor’s office.

- Access the Tax Map: Look for the link or section labeled "Tax Map," "Property Records," or "Assessor’s Database."

- Explore the Map: Use the interactive features to zoom, pan, and search for specific properties.

- View Property Details: Click on a property to access detailed information, including its PIN, address, owner information, and assessed value.

Frequently Asked Questions

Q: What is the purpose of the Putnam County Tax Map?

A: The Putnam County Tax Map serves as a comprehensive database of property information, facilitating property ownership identification, tax assessment, and land use planning.

Q: How can I find a specific property on the map?

A: You can search for properties using their address, PIN, or owner name through the online map’s search functions.

Q: What information can I find about a property on the map?

A: The map provides detailed information about each property, including its address, PIN, owner information, assessed value, land use, zoning restrictions, and tax information.

Q: Is the Putnam County Tax Map updated regularly?

A: Yes, the tax map is updated regularly to reflect changes in property ownership, land use, and other relevant information.

Q: Can I download property data from the map?

A: Many online platforms allow users to download property data in various formats, facilitating further analysis and use in other applications.

Tips for Utilizing the Putnam County Tax Map

- Familiarize Yourself with the Map: Spend time exploring the map’s features and navigating its interface to gain a comprehensive understanding of its functionalities.

- Utilize Search Functions: Leverage the search functions to quickly locate specific properties based on address, PIN, or owner name.

- Explore Property Details: Click on individual properties to access detailed information, including its assessed value, zoning restrictions, and tax obligations.

- Overlay Data Layers: Utilize the map’s layering capabilities to overlay different data sets, such as zoning districts, flood zones, or school boundaries, for comprehensive analysis.

- Contact the Tax Assessor’s Office: If you have any questions or require further assistance, contact the Putnam County Tax Assessor’s Office for guidance.

Conclusion

The Putnam County Tax Map stands as a vital resource for understanding and navigating the county’s intricate real estate landscape. This comprehensive tool empowers residents, investors, professionals, and government agencies with access to valuable information about property ownership, land use, and tax assessment. By utilizing its user-friendly interface and robust features, individuals can gain insights into the county’s property market, make informed decisions, and contribute to the ongoing development and prosperity of Putnam County.

Closure

Thus, we hope this article has provided valuable insights into Unveiling the Land: A Comprehensive Guide to Putnam County Tax Maps. We hope you find this article informative and beneficial. See you in our next article!