Navigating the Landscape: Understanding Lincoln County Tax Maps

Related Articles: Navigating the Landscape: Understanding Lincoln County Tax Maps

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape: Understanding Lincoln County Tax Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape: Understanding Lincoln County Tax Maps

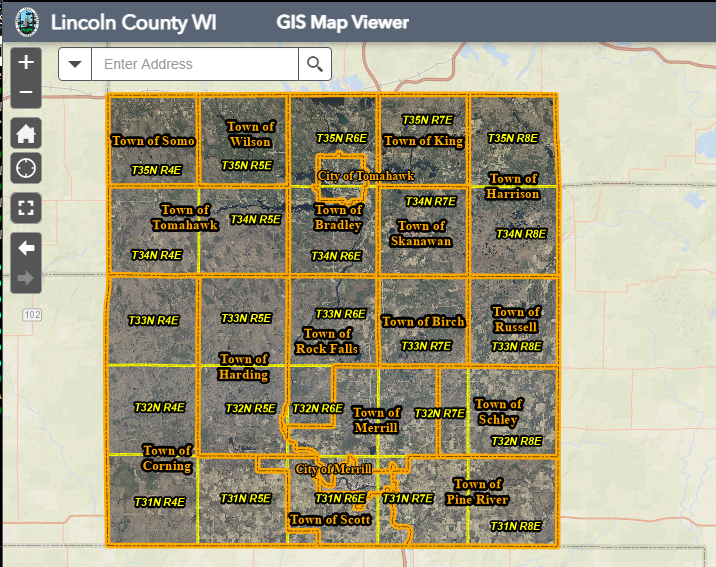

Lincoln County tax maps are indispensable tools for navigating the complex world of real estate and property ownership. These maps, often maintained and updated by county assessors, provide a visual representation of land parcels within the county, offering detailed information about each property.

Delving into the Depths: Understanding the Components of Lincoln County Tax Maps

Lincoln County tax maps typically contain a wealth of information, including:

- Parcel Numbers: Each property within the county is assigned a unique parcel number, serving as a primary identifier.

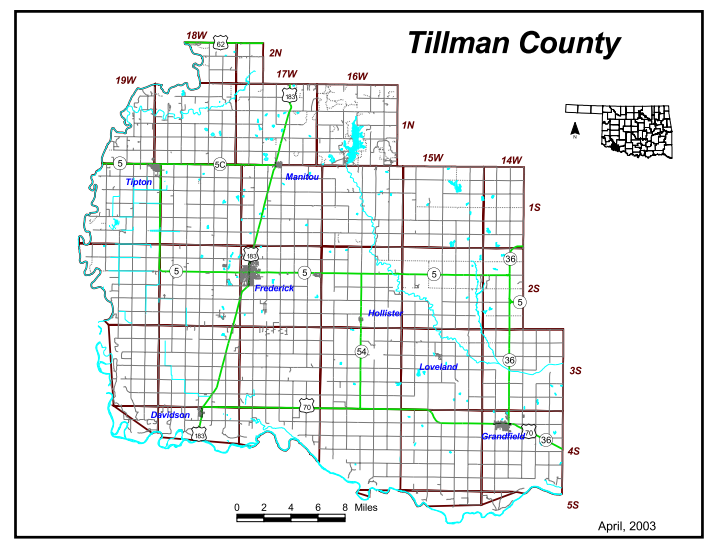

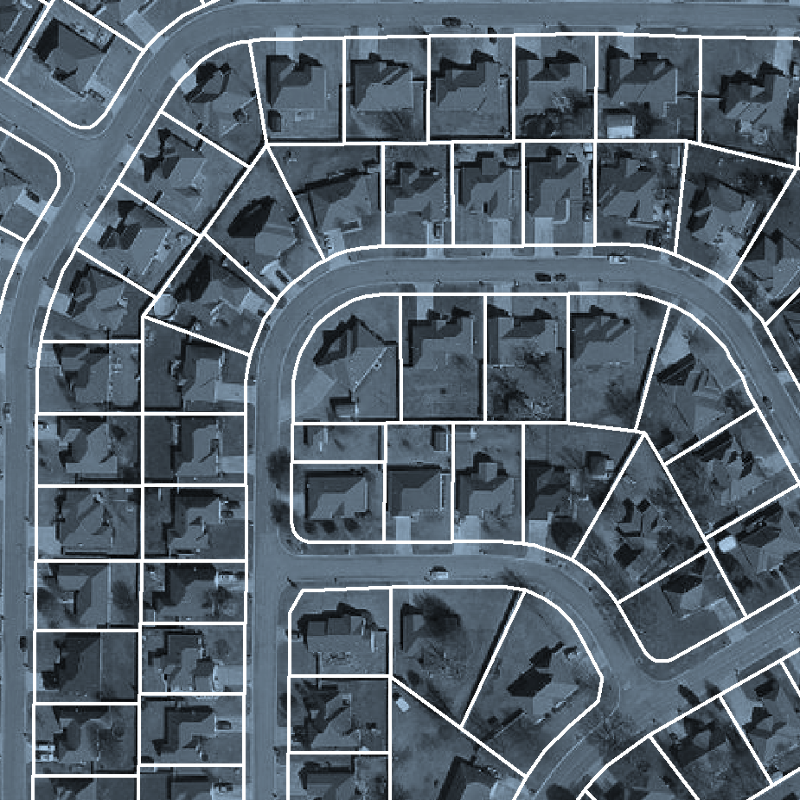

- Property Boundaries: The maps clearly delineate the boundaries of each parcel, ensuring accurate representation of ownership and size.

- Property Ownership: The maps indicate the current owner of each property, often including their name and contact information.

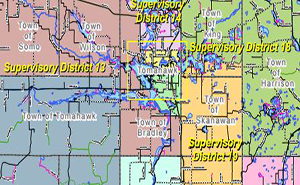

- Property Classification: Tax maps often categorize properties based on their use, such as residential, commercial, or agricultural.

- Land Use: The maps may display details about the permitted or current use of the land, such as zoning regulations and building restrictions.

- Property Value: Tax maps frequently include an estimated value of each property, serving as a basis for property tax assessments.

- Tax Information: The maps may provide information about property taxes, including the tax rate and any outstanding payments.

Accessing and Utilizing Lincoln County Tax Maps: A Guide to Exploration

Lincoln County tax maps are typically accessible through various channels:

- County Assessor’s Website: Most counties maintain online databases of their tax maps, allowing for convenient access and search functionality.

- County Assessor’s Office: In-person visits to the county assessor’s office provide access to physical copies of tax maps or digital versions.

- Third-Party Websites: Some websites specialize in providing access to property records and tax maps, often offering additional features and data.

The Importance of Lincoln County Tax Maps: A Gateway to Informed Decisions

Lincoln County tax maps play a crucial role in various aspects of real estate and property management:

- Property Identification: The maps serve as a reliable tool for identifying specific properties within the county, facilitating accurate recordkeeping and ownership verification.

- Property Valuation: Tax maps provide a foundation for property valuation, aiding in determining fair market value for purchase, sale, or taxation purposes.

- Property Management: Landowners and property managers utilize tax maps to understand property boundaries, zoning regulations, and potential development restrictions.

- Property Tax Assessment: Tax maps are integral to the property tax assessment process, ensuring equitable distribution of tax burdens across the county.

- Real Estate Transactions: Real estate professionals rely on tax maps for property identification, boundary verification, and understanding property characteristics during transactions.

- Planning and Development: Urban planners and developers utilize tax maps to assess available land, identify potential development sites, and understand existing infrastructure.

- Public Access and Transparency: Tax maps promote transparency and public access to property information, fostering accountability and informed decision-making.

Frequently Asked Questions about Lincoln County Tax Maps

1. How do I find a specific property on the Lincoln County tax map?

Most county assessor websites offer search functionalities based on parcel numbers, property addresses, or owner names. You can also visit the assessor’s office in person for assistance.

2. Are Lincoln County tax maps always accurate?

While county assessors strive for accuracy, errors can occur. It is advisable to verify any information obtained from tax maps with official records or through independent research.

3. How often are Lincoln County tax maps updated?

The frequency of updates varies by county. However, most assessors strive to maintain current information, reflecting changes in ownership, property boundaries, or land use.

4. Can I use Lincoln County tax maps for legal purposes?

Tax maps can provide valuable information for legal purposes, but it is essential to consult with legal professionals for specific guidance.

5. What is the difference between a tax map and a property deed?

A tax map provides a visual representation of property boundaries and ownership, while a property deed is a legal document outlining the rights and ownership of a specific property.

Tips for Utilizing Lincoln County Tax Maps Effectively

- Familiarize yourself with the map’s legend: Understand the symbols and abbreviations used on the map to interpret information accurately.

- Use multiple resources: Cross-reference information from different sources, including official records and third-party websites, for comprehensive understanding.

- Consult with experts: Seek guidance from professionals, such as real estate agents, attorneys, or surveyors, for complex or legal matters.

- Stay updated: Check for updates to tax maps regularly, as information can change due to property transactions or development.

Conclusion

Lincoln County tax maps serve as invaluable resources for navigating the complex landscape of real estate and property ownership. These maps provide a visual representation of property boundaries, ownership, and other important details, facilitating informed decision-making for individuals, businesses, and government agencies. Understanding the components, accessing methods, and limitations of tax maps empowers users to make informed choices regarding property transactions, development, and taxation. By utilizing these resources effectively, individuals can gain a deeper understanding of the property landscape within Lincoln County, fostering transparency and informed decision-making.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: Understanding Lincoln County Tax Maps. We appreciate your attention to our article. See you in our next article!