Navigating Rural Arizona: A Guide to USDA Loan Eligibility

Related Articles: Navigating Rural Arizona: A Guide to USDA Loan Eligibility

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Rural Arizona: A Guide to USDA Loan Eligibility. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating Rural Arizona: A Guide to USDA Loan Eligibility

- 2 Introduction

- 3 Navigating Rural Arizona: A Guide to USDA Loan Eligibility

- 3.1 Delving into the USDA Loan Map

- 3.2 How to Utilize the USDA Loan Map

- 3.3 The Importance of the USDA Loan Map in Arizona

- 3.4 Exploring USDA Loan Eligibility in Arizona

- 3.5 FAQs Regarding USDA Loans in Arizona

- 3.6 Tips for Securing a USDA Loan in Arizona

- 3.7 Conclusion

- 4 Closure

Navigating Rural Arizona: A Guide to USDA Loan Eligibility

The United States Department of Agriculture (USDA) offers a range of loan programs designed to assist eligible individuals in purchasing, building, or rehabilitating homes in rural areas. These loans, often referred to as USDA Rural Development loans, can be a valuable tool for individuals seeking to establish roots in rural communities across Arizona. Understanding the eligibility criteria and geographical coverage of these programs is essential for potential borrowers.

Delving into the USDA Loan Map

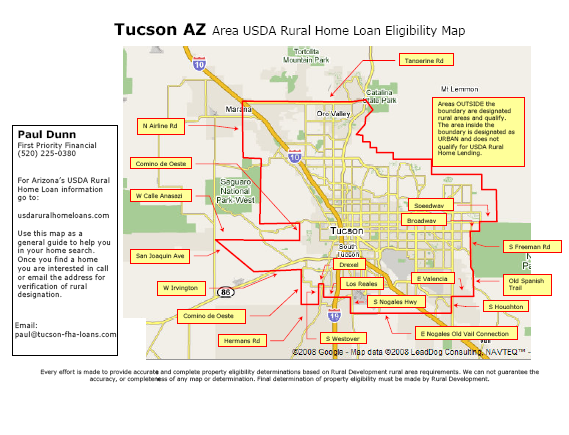

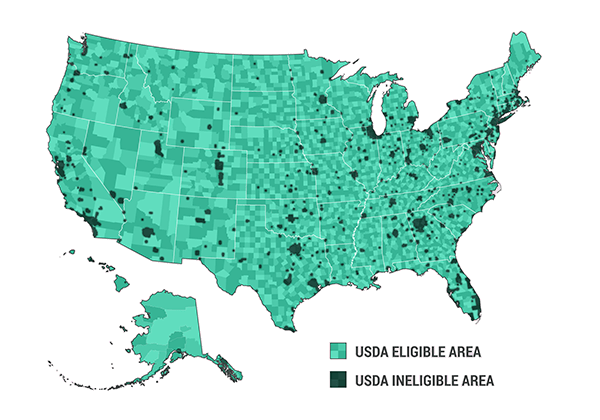

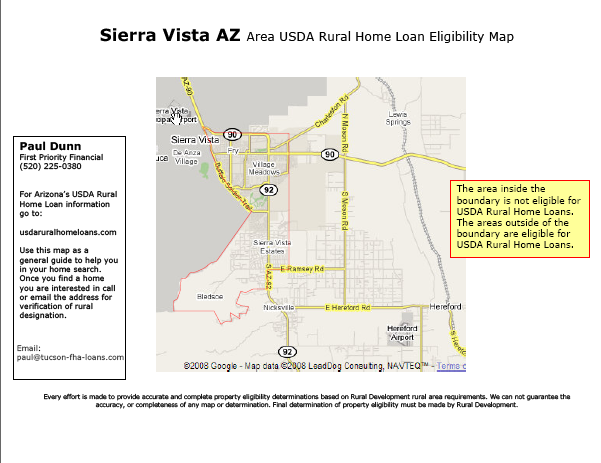

The USDA Rural Development loan program encompasses a specific geographical area defined by the agency. This area, often referred to as the "USDA Rural Development Map," is a critical factor in determining eligibility for the program. The map outlines the eligible areas, including those within and outside of urbanized areas.

To utilize these loans, potential borrowers must reside in an area deemed eligible by the USDA. This eligibility is determined based on several factors, including population density, proximity to urban centers, and economic indicators.

How to Utilize the USDA Loan Map

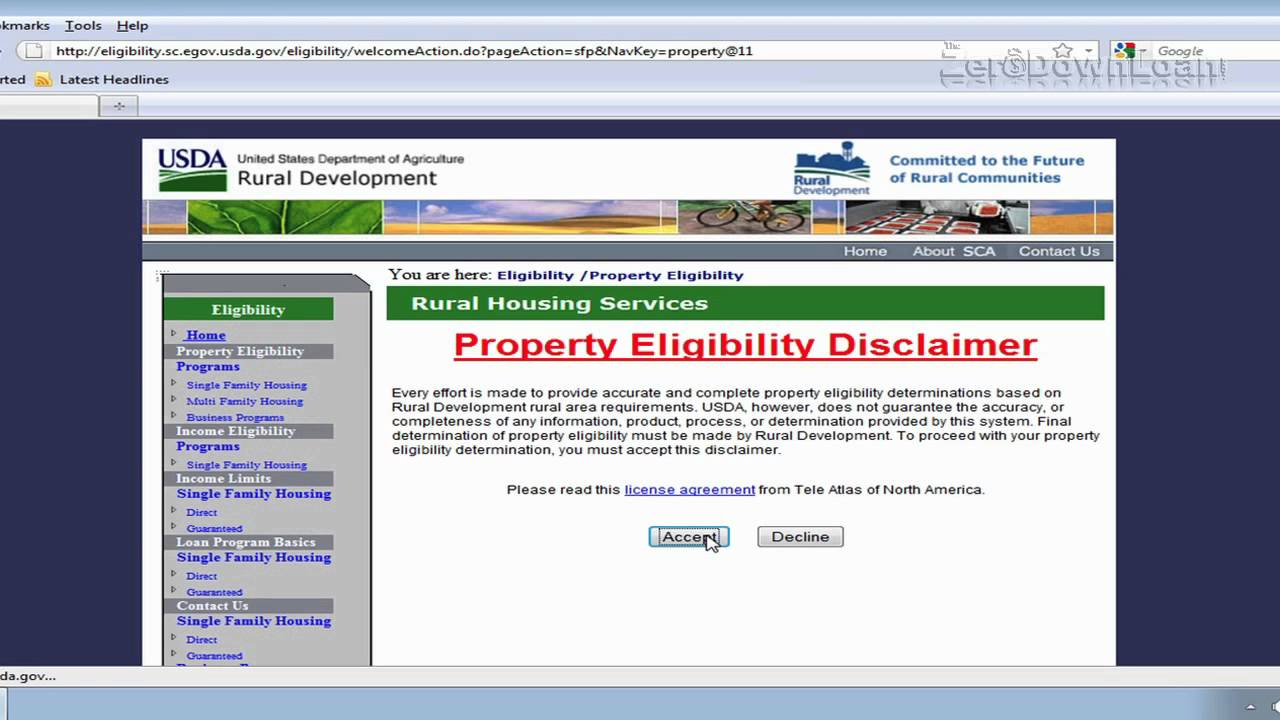

The USDA Rural Development map is a valuable resource for individuals considering applying for a loan. It provides a visual representation of eligible areas, allowing potential borrowers to ascertain their eligibility based on their desired location.

Here’s how to utilize the map effectively:

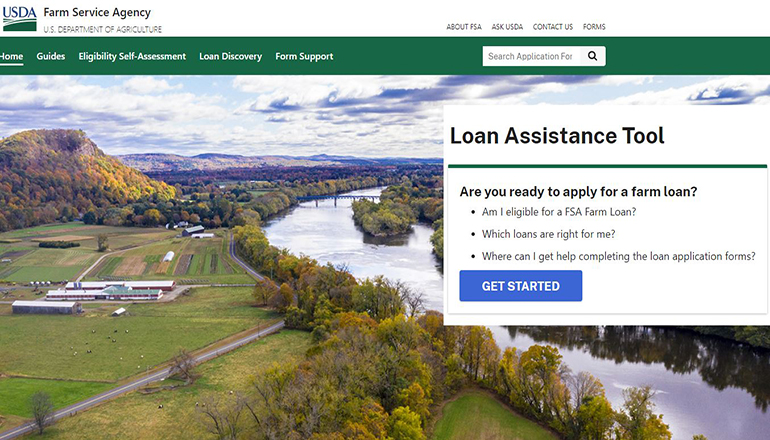

- Access the USDA Rural Development website: The official website offers a comprehensive online map tool.

- Enter your desired location: Use the search function to pinpoint your preferred location in Arizona.

- Analyze the map: The map will indicate whether your chosen location is eligible for USDA Rural Development loans.

Understanding the Map’s Color Coding:

The map employs color coding to illustrate eligibility:

- Green: Indicates areas eligible for USDA Rural Development loans.

- Yellow: Represents areas that may be eligible, depending on specific circumstances.

- Red: Denotes areas ineligible for USDA Rural Development loans.

The Importance of the USDA Loan Map in Arizona

The USDA Rural Development map plays a vital role in Arizona, a state with diverse landscapes ranging from bustling urban centers to sprawling rural communities. The map serves as a guide for individuals seeking affordable homeownership options in rural areas.

Benefits of using the map:

- Identifying eligible locations: The map helps narrow down potential locations based on USDA loan eligibility.

- Facilitating informed decision-making: It empowers individuals to make informed decisions regarding their desired location based on the availability of USDA loan programs.

- Promoting rural development: The map plays a crucial role in promoting economic growth and development in rural communities by encouraging homeownership.

Exploring USDA Loan Eligibility in Arizona

While the map provides an initial overview of eligibility, it’s essential to delve deeper into the specific requirements for USDA loans.

Here are some key eligibility criteria:

- Income: Borrowers must meet income limitations based on household size and location.

- Credit score: A minimum credit score is generally required.

- Property type: Loans are typically available for single-family homes, townhouses, condominiums, and manufactured homes.

- Location: As previously mentioned, the property must be located in an eligible rural area.

- Purpose: Loans can be utilized for purchasing, building, or rehabilitating a home.

FAQs Regarding USDA Loans in Arizona

Q: What are the income limits for USDA loans in Arizona?

A: Income limits vary based on household size and location. The USDA website provides a comprehensive income chart outlining the specific limits for each county in Arizona.

Q: What are the credit score requirements for USDA loans?

A: The minimum credit score requirement for USDA loans is generally 640. However, specific requirements may vary depending on the lender.

Q: Are there any closing costs associated with USDA loans?

A: Yes, there are closing costs associated with USDA loans. These costs may include appraisal fees, loan origination fees, and title insurance.

Q: What are the interest rates on USDA loans?

A: Interest rates on USDA loans are typically fixed, and they are generally competitive with conventional mortgages.

Q: What is the maximum loan amount for USDA loans in Arizona?

A: The maximum loan amount for USDA loans varies based on location and property value. It’s recommended to contact a USDA-approved lender for specific information.

Tips for Securing a USDA Loan in Arizona

Here are some helpful tips for maximizing your chances of securing a USDA loan:

- Improve your credit score: Work towards improving your credit score by paying bills on time and reducing outstanding debt.

- Shop around for lenders: Compare interest rates and closing costs from different USDA-approved lenders.

- Understand the eligibility requirements: Carefully review the eligibility criteria for USDA loans to ensure you meet the necessary qualifications.

- Get pre-approved for a loan: Pre-approval can demonstrate your financial readiness to lenders and expedite the loan process.

- Prepare all necessary documentation: Gather all required documents, such as income verification, credit reports, and property appraisal.

Conclusion

The USDA Rural Development map is a crucial resource for individuals seeking affordable homeownership options in rural Arizona. By understanding the eligibility criteria and exploring the map’s features, potential borrowers can identify suitable locations and navigate the application process effectively. By utilizing the map and following the outlined tips, individuals can increase their chances of securing a USDA loan and realizing their dream of homeownership in rural Arizona.

Closure

Thus, we hope this article has provided valuable insights into Navigating Rural Arizona: A Guide to USDA Loan Eligibility. We hope you find this article informative and beneficial. See you in our next article!